Analysis: Minto REIT Stocks and Property in Downward Trend

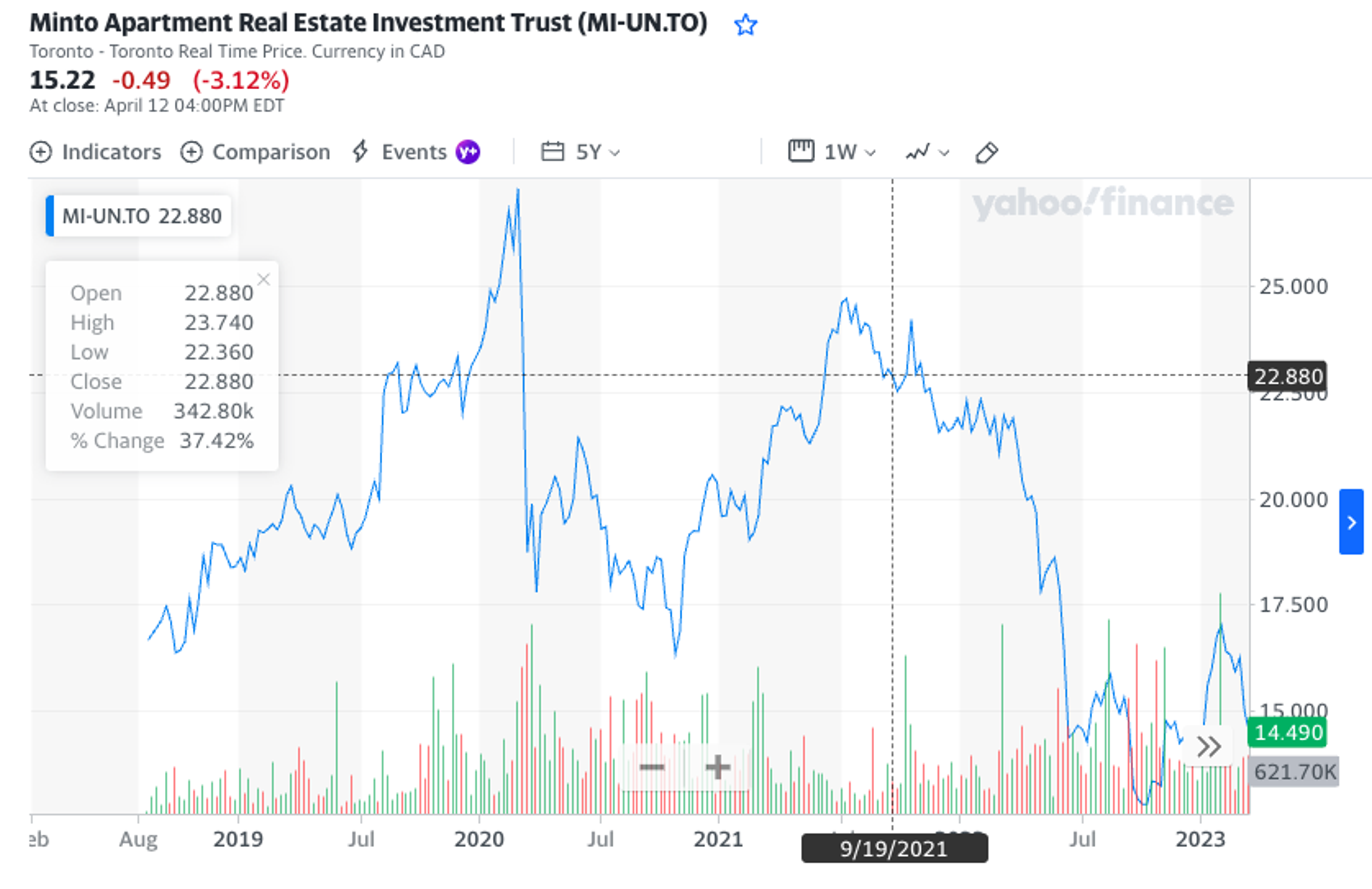

Since Minto REIT was initially offered on the TSX at $16.59 per share, their stock has been on a roller-coaster ride that has more recently ended below the initial price, meaning Minto has lost money on all of the shares it has owned since the start. In fact, since the end of the pandemic, Minto REIT stock has fallen from a high of $27.31 in March 2020 to a stagnant value around $15, meaning an approximate loss of $10M in share values held by Minto, instead of a $40M gain at its highest. Considering the IPO brought in $200M, that's an overall 5% loss of value - not Elon Musk level, but still a noticeable loss, and not heading in the right direction.

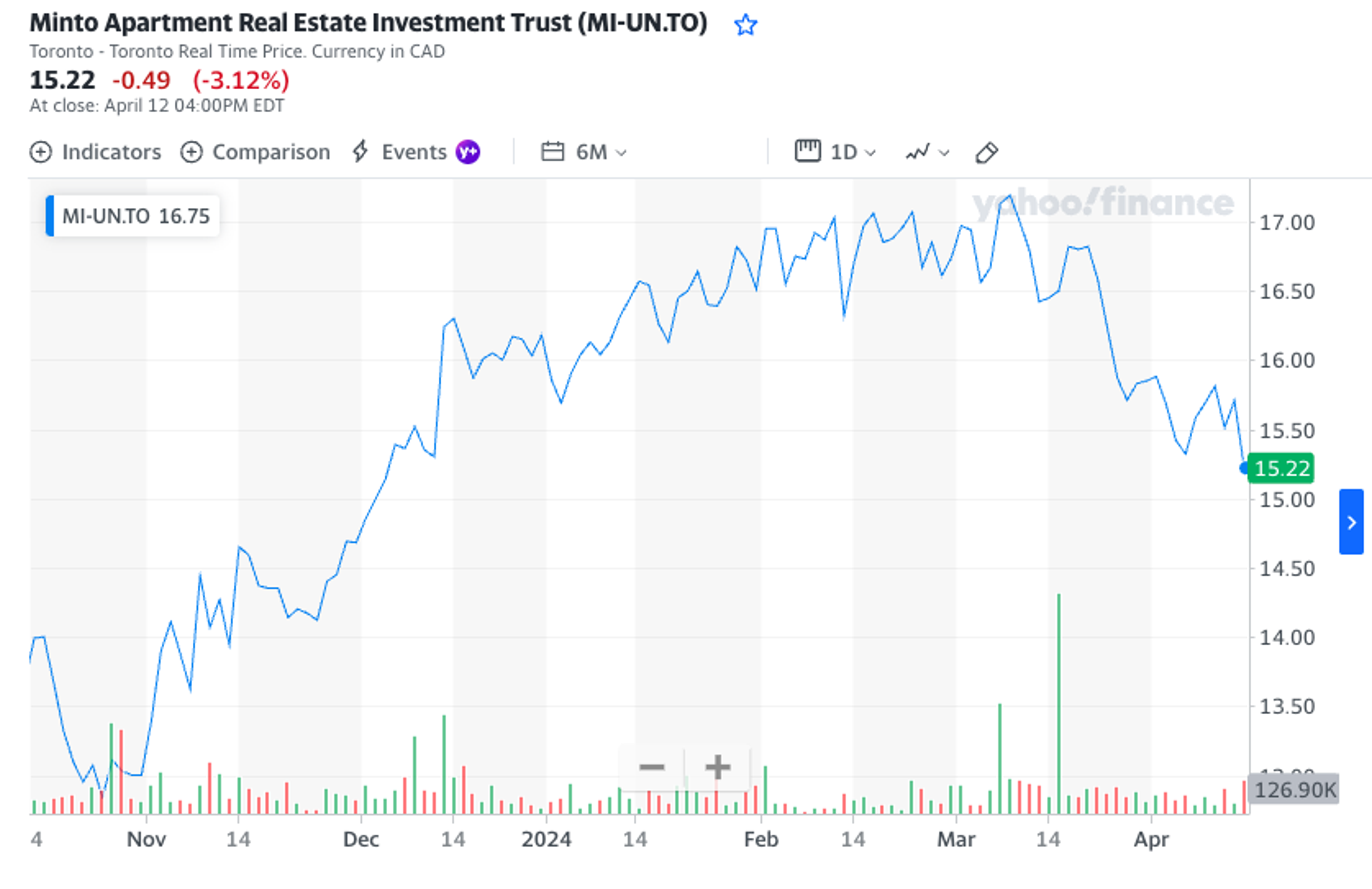

In an effort to generate momentum, Minto REIT has been steadily increasing its monthly dividend from a low of $0.037 per share during the pandemic to its current value of $0.0421 per share in 2024.

The latest increase was voted by the board November 7 2023, and the price has gone up from $13 to $17.20 March 8 2024, generating tremendous paper value for Minto Group, the majority shareholder of Minto REIT. This gain was short lived, however: after the release of the 2023 Annual Report on March 6 2024, the stock has tumbled down 11% to 15.22, nearly nullifying the boost in price that the increased dividends produced. The high level of selling last week means the stock could continue free-falling to its lowest level and beyond.

Retail investors often look for stocks that pay the best dividends to place their retirement savings. They sometimes forget that there is no guarantee that the dividends will continue to grow with inflation if the underlying business is not properly managed. This is especially true of REITs that try to attract non-institutional investors with a promise of steadily increasing monthly dividends, hoping they won't look at the fundamentals and the ensuing market price impacts.

Combined with the tax incentive for Canadian REITs to avoid keeping any retained earnings (rental revenue minus expenses), it becomes clear that the temptation of short-term stock gains by extracting as much money as possible from the business sacrifices the long-term sustainability as important repairs are delayed and the infrastructure conditions are allowed to degrade in order to pay for the increased dividends. These speculative tactics will relegate Minto REIT to a junk stock which dividend investors will punish by moving their savings to an investment with sounder fundamentals.

Unfortunately for tenants, this means spending decisions are being taken with a penny-wise, pound-foolish approach. Unless Minto REIT leans into the failure of this attempt to prop up the stock price through the extraction of "funds from operation", and ensures the fundamentals of the property are sound, there is no telling how low Rockhill will go - on the exchange, and in real life.

Welcome to Rockhill, a charming fixer-upper with a glorious past